So you want to see your name in lights. Media coverage is one of the best and least expensive ways to let the world know about you and your company (or rock band for that matter). The trouble with media coverage is that you can’t buy it or send a regular email to get it. With a couple of simple tools you can create a press kit that will help you attract the attention of local media outlets. (This is part 3 of a 3 part series. If haven’t already, start with Part 1: The Media List and Part 2: The Press Release.)

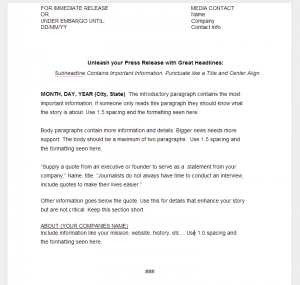

The press kit provides additional support for your media campaign. Typically you send a press kit to follow up if a journalist is interested in your story. Every press kit is a bit different. However, there are a number of standard documents you should include. You can be creative with the press kit and include more than what is listed here.

FAQ: People are likely to have additional questions about you and your product. Provide answers to those questions here. Include relevant details that were not critical to your press release.

Bios: Provide background information about your core team in this document. This is similar to a resume--however, it is written out. Start with most recent items and work your way backwards. This should be fairly straight forward.

Fact Sheet: The fact sheet is a bulleted list of all the important information contained in your press release and press kit. Think of this as an outline of your press release and press kit.

Company Background: Write about your company's background and history. You can talk about previous accomplishments and important events.

Picture: Include a picture of you or your product. Make sure it is relevant to the story.

Now that you have a great media list, a compelling press release and an awesome press kit, it's time to find your business some exposure. Send your press release to the people listed on your media list, then follow up with your press kit when reporters and journalists contact you!

About the Author: Steve Anderson is an entrepreneur who lives in Milwaukee, Wisconsin. Currently he is the COO of LessonLogs and the Founder of Laylines Consulting. He has helped numerous companies obtain seed stage funding and is a previous winner of Startup Weekend Madison. In addition, Steve has a Masters Degree from the Wisconsin School of Business. Find him on Twitter: @LaylinesSteve