Who will be judging reverse pitch?

The judges will include senior executives, individuals responsible for Venture Capital sources and the innovation team at Northwestern Mutual.

What criteria will be used for reverse pitch?

Judges will rate low, medium, high in the following categories. Proposed Product / Solution, Business & Revenue Model, Competitive Positioning, Strength of Management, Consideration of Risks and Use of Investment.

Does the pitching company have to be a startup or can an existing business pitch?

No. Growing businesses in SE Wisconsin will be preferred whether they are new or existing. Northwestern Mutual is looking to invest in a business for mutual value.

What details are available on the SAFE round?

- Northwestern Mutual will provide $10,000 to create a legal entity eligible for investment

- Northwestern Mutual will invest up to $75,000 in three (3) tranches based on agreed upon Milestones

- Last look right – Right to match the terms of any subsequent qualified financing offer

- Right of first refusal - Right to the first commercial application of any product or solution created by the Company on mutually agreeable commercial terms

What kind of mentorship and guidance is available to pitching companies?

By collocating with the innovation team at Northwestern Mutual, access to mentors, SMEs and business advisors will be available. Additional options are also available based upon need from 3rd party organizations.

Will we have to sign an NDA to get access to more information?

Potentially. For example, to access Northwestern Mutual proprietary data, appropriate steps must be completed.

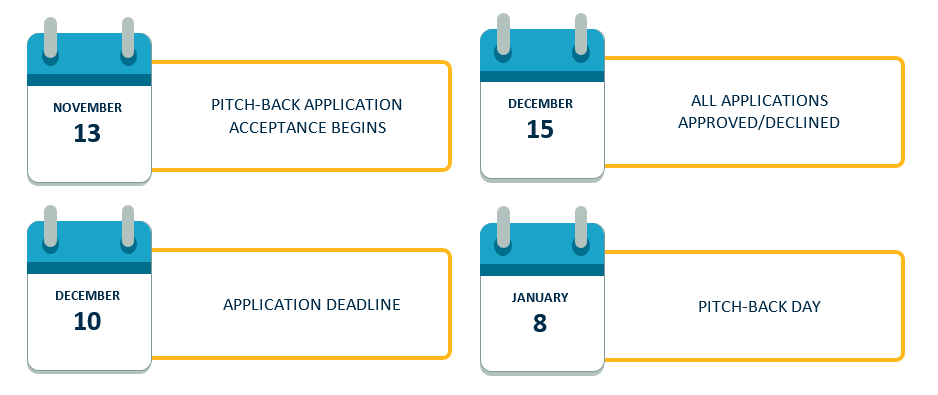

What are the key dates and timeframes for us?

How much of a demo / MVP does a team need to pitch back?

The judges are business people who will need to see something to understand your solution. The closer to the future working product, the better. Visual click through demos are a minimum requirement.

What if my startup is pursuing other funding models? Can we propose other funding models?

Absolutely. Northwestern Mutual may or may not be able to flex to some models.

Is there an option for more investment beyond $85,000?

Yes, based upon growth and milestone achievements.

What if I am interested in pitching, but can’t make it on January 8th?

Since the group of judges have busy schedules, it would be difficult to judge a pitchback outside of that event. If this is a significant constraint, please talk with David Rice.

What should I include in my pitch-back application?

Please include all materials you would like to be considered in your application, including a rough draft of your pitch deck (business plan, business model canvas, wireframes, etc). Materials will not be considered final, but will be used to determine which applicants can pitch on January 8th.

How long do I have to pitch at the January 8th event?

If your application is accepted to pitch back to Northwestern Mutual judges, you will have 20 minutes to present the idea and all related materials.

Materials needed for the event:

Any material you will need to present your idea. If you are using technology as part of your presentation, don’t forget your power cord. We will provide you the connectors to our Wi-Fi and displays. Please note, you will not be able to print or use a thumb drive to present your idea.

If we are selected to pitch on January 8th, will we be able to see other teams pitch? Will other teams hear ours?

No. We will consider each team’s business plan/solution to be proprietary to them. Only a team from Northwestern Mutual will sit in on the pitches.

Will the leading idea be selected by the panel on January 8th? If not, when will we know if we will be offered an investment?

Investment decisions will not be made on January 8th. Northwestern Mutual will follow up with teams by the end of the month.

Can existing startups that have solutions to Northwestern Mutual problem statements apply?

Absolutely. We welcome existing startups that can solve these problems. Companies who already have a determined valuation should include that information in their pitch.